Smart Real Estate Strategies for a Volatile Housing Market

- TCS Hello

- 1 day ago

- 3 min read

The Contradiction of Building During a Downturn

At first glance, launching a new real estate project during a recession seems counterintuitive. Economic slowdowns often bring tighter credit, weaker demand, and increased uncertainty.

But historically, downturns have also opened doors for strategic investors.

During the Great Recession, U.S. housing starts dropped sharply—from over 2 million units in 2005 to just 554,000 by 2009, a 73% decline (St. Louis Fed). Despite that collapse, developers who laid the groundwork early often completed projects just in time for the rebound.

Real estate isn’t just about timing the market. It's about preparing before conditions improve. Investors who understand zoning, permitting timelines, and land use laws position themselves ahead of the next cycle.

The Long Game: Why Timing the Recovery Starts During the Recession

Real estate development is a long process. Between architectural planning, financing, permitting, and construction, a typical project can take 12 to 24 months—or longer.

Builders who initiated projects in 2010 and 2011 were often best positioned when demand returned in 2013 and beyond. Those who waited until headlines turned positive missed the window.

You don’t win by reacting to the market. You win by building through it, with the right data in hand.

Cost Advantages of Building in a Down Market

Downturns often unlock pricing power for developers. Key advantages include:

Lower land costs, especially for underutilized lots

Increased labor availability, as competition slows

Potential drops in material prices, depending on global supply chain trends

Faster permitting turnaround, as application volume declines

These conditions allow for more efficient execution—if you understand your site’s zoning, overlays, and restrictions before purchasing.

Why Zoning Matters More Than Ever in a Recession

In a slow market, value isn’t always in price appreciation. It’s in build potential.

Zoning laws determine:

What can be built (e.g., single-family, ADU, duplex, or mixed-use)

How much can be built (e.g., square footage limits, FAR, density)

Where restrictions apply (e.g., hillside overlays, fire zones, historic districts)

Zoning isn't static. Cities frequently adjust land use policy to encourage more housing or climate resilience. According to McCoy Valuation, upzoning can significantly increase a property's value by unlocking development opportunities that weren’t previously available.

Examples of High-Value Projects Even in a Downturn:

Accessory Dwelling Units (ADUs)

ADUs are secondary units built on existing residential lots. According to the Terner Center for Housing Innovation, ADUs are cost-effective, increase housing supply, and offer long-term rental income. They're especially popular in cities like Los Angeles and San Diego, where housing demand remains strong.

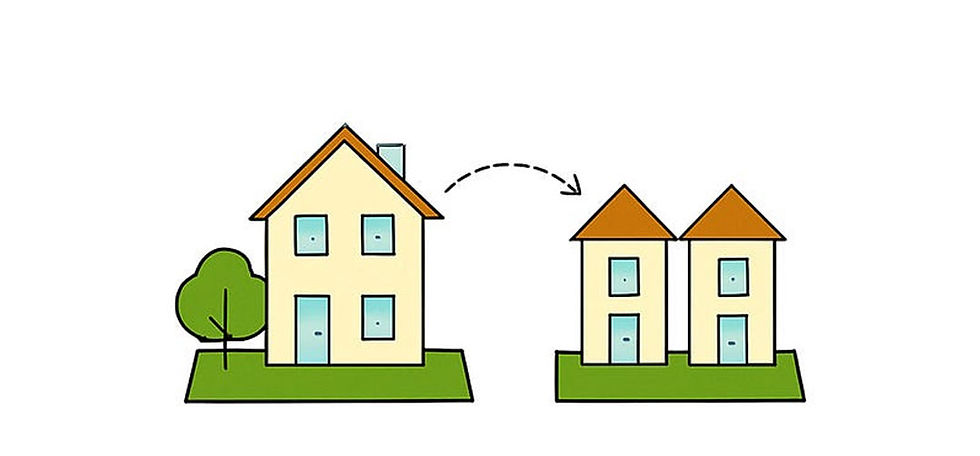

Small-Lot Subdivisions

Dividing a larger parcel into smaller individual lots for townhomes or duplexes is a smart infill strategy. These projects increase density and affordability in urban markets. Thesis Driven outlines how these subdivisions are gaining traction in cities with progressive land use policies.

Conversions of Underutilized Properties

Converting single-family homes or commercial buildings into multi-unit rentals or mixed-use spaces makes better use of land. The Regional Plan Association has shown that such conversions add needed housing without new sprawl or large-scale rezoning.

Teardown and Rebuild in Upzoned Areas

In markets where zoning laws have shifted to allow greater density, tearing down older homes and rebuilding new multi-unit housing can create significant value. The National Association of Home Builders reports that these infill strategies are critical to solving long-term affordability.

Smart Investment Strategies During a Recession

Focus on Income-Producing Properties

Rental properties generate consistent cash flow, which helps offset short-term market volatility. During recessions, demand for rentals can increase as fewer people qualify for homeownership.

Diversify Across Property Types and Markets

Investors who hold a mix of residential, commercial, and mixed-use properties across various regions are better insulated from local downturns.

Consider Real Estate Investment Trusts (REITs)

For investors seeking liquidity and passive income, REITs offer exposure to real estate without requiring direct ownership. Many REITs outperform in low-growth environments due to their dividend focus (Investopedia).

Maintain Strong Liquidity

Having capital on hand allows investors to act quickly on distressed opportunities. Cash flow and reserves reduce the need for high-interest loans in uncertain credit environments.

Final Takeaway: Build Smart, Not Fast

Recessions don’t stop experienced investors, they create space for strategic movement.

When others step back, the landscape becomes less competitive. Landowners become more negotiable. Permitting timelines often shrink. Construction costs may stabilize. But success in these moments doesn’t come from moving quickly, it comes from moving deliberately.

Understanding what a property can legally support and where risk or opportunity lies is how investors reduce uncertainty and position themselves for the recovery. The smartest plays are rarely the flashiest. They’re thoughtful, well-timed, and backed by research.

In volatile markets, it's not just about when you invest it's about what you build and where. Focus on knowledge. Focus on precision. The rebound will come, and the groundwork you lay now determines how ready you'll be when it does.

Comments